Spending money to show people how much money you have is the fastest way to have less money.

- Morgan Housel

How much money did you spend at the grocery store last month?

If the answer to that question is “I don’t know,” you are not alone. In fact, that's exactly what the majority of American adults would say. By the end of this first step, however, you will know the answer.

Taking the first step is often the hardest part, so we will be here to guide you through. If you trust the process, it will work.

In this first step you will learn how to calculate two things:

- Your Total Income

- Your Total Expenses

This may seem a bit basic, but it serves as the foundation for any proper financial plan. Whether it's a family budget or a Fortune 500 company, you need to understand what is coming in and what is going out.

After you figure out these important numbers, we will move on to Step 2, Make a Budget and Track Your Money. For many, this may be the first budget you have ever done. If that is the case, don’t sweat it. It's not as complicated as many people think.

Table of Contents

Finding Your Total Income

There are three primary ways that people earn money, and a few not-so-common ones. The vast majority will receive money through:

- Wages

- Self-employment

- Investments

Additionally, there may be money coming in from (not limited to):

- Alimony

- Child Support

- Annuities

- Settlements

- Pensions

We will work on a monthly basis, since most bills and paychecks line up nicely with that time frame. Additionally, we will assume you are using a spreadsheet, but a piece of paper will work as well.

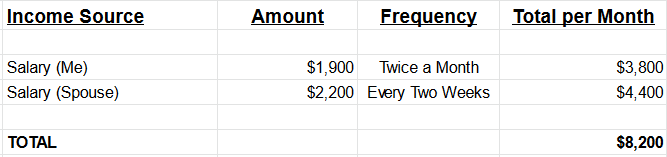

Write a list of all your income sources, along with the amount and the frequency you receive it. If it varies (such as hourly or self-employment) look at the last three months or so and calculate the average. Remember your spouse or anyone else that contributes to the household expenses.

Don’t worry about taxes, retirement savings, etc. The only number we are concerned with at this point is how much money you have available each month to pay for things. So the amount that actually gets deposited into your bank after deductions.

If you receive a paycheck every other week (instead of once or twice a month), that means there are two months a year where you receive three paychecks. We suggest using the number from two paychecks to create your budget, so those three paycheck months are like little bonuses you can use to expedite future goals.

Once you have calculated how much money comes into your household on a monthly basis, highlight that number.

Mini Summary

- List all your income sources

- Calculate how much you take home each month

- Write that number down

Finding Your Total Expenses

Now that you know how much money you make, it's time to find out how much money you spend.

A word of caution as we venture into this part. Digging through your spending habits can be an eye-opening and emotional process if you haven’t done it before. It can be easy to gloss over certain things, or ignore specific expenditures for a variety of reasons. It will not serve you well in the long run unless you are honest about everything. If you have a significant other, the same goes for them and their expenses.

The goal of this section is to find out how much money, on average, goes out of your household on a monthly basis, and put those numbers into categories. The categories are not that important at this step, so long as everything is counted and ends up in one of them.

The way to think about categories is in two levels. You have a Top category, and then multiple Sub categories. Like this:

- Fixed Expenses (Top)

- Rent/Mortgage (Sub)

- Cell Phone (Sub)

- Variable Expenses (Top)

- Groceries (Sub)

- Fuel (Sub)

And so on…

The number of top and sub-categories you end up with is completely up to you, and we will cover more of that when we get to the budgeting part. For now, let's start with four Top level categories:

- Fixed Expenses

- Variable Expenses

- Debt Payments

- Miscellaneous

Defining The Categories

Before we proceed, let's define what these categories mean as we do this exercise.

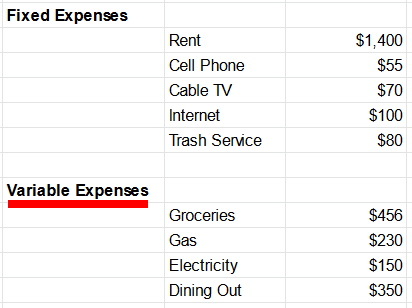

Fixed Expenses

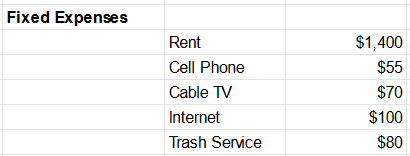

For our purpose, we use the term Fixed Expenses to mean anything that doesn’t really vary in cost from month-to-month. Examples of fixed expenses are:

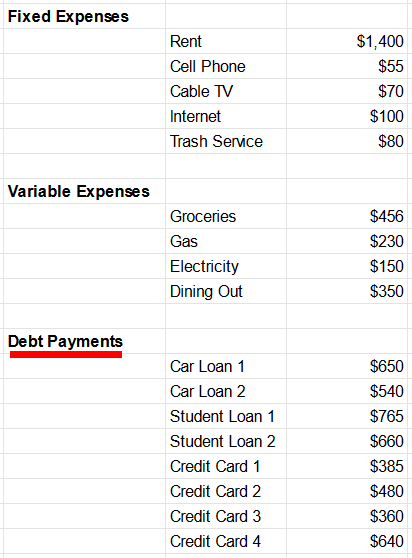

Variable Expenses

The Variable Expenses category is where we keep track of those costs that change every month. Here are some examples:

- Groceries

- Transportation / Gas

- Electricity

- Dining Out

- Entertainment

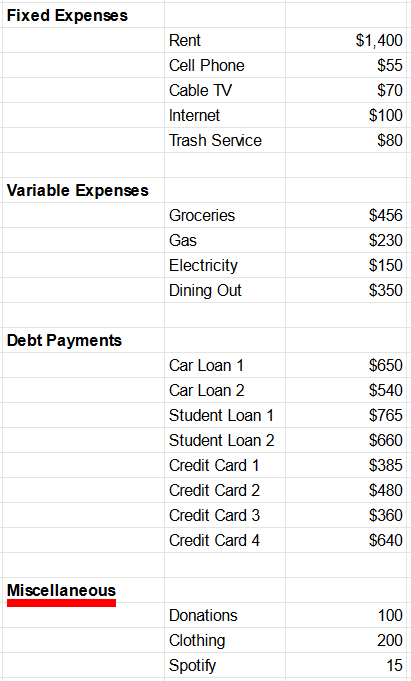

Debt Payments

This is the top category where we list all the minimum monthly debt payments. So even if you are paying more than the minimum and trying to pay something off, for this purpose we want to list the minimum amount you are required to pay. (Note Mortgage was added under Fixed Expenses for this step.) Here are examples:

- Car Loan

- Student Loan

- Personal Loan

- Credit Card Minimum Payments

- Furniture Loans

- Boat / RV Loans

Miscellaneous

This is the catch-all category for anything that doesn’t fit neatly into one of the other sections. There really isn’t any rule to what can be placed here, just make sure everything ends up somewhere. Examples:

- Kid Sports Fee

- Uber / Lyft

- Birthday Gifts

- Christmas Gifts

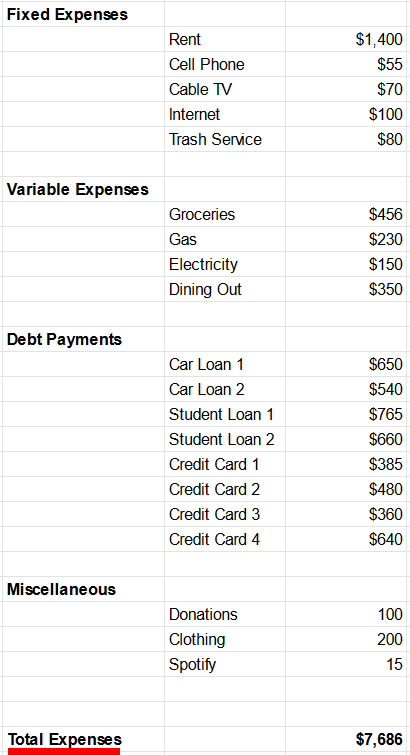

Example

Here is what our above examples would look like all together. Yours will certainly look different as you start adding them in the next section, so don’t worry if you have a lot more or less:

- Fixed Expenses

- Rent/Mortgage

- Cell Phone Bill

- School Tuition

- Daycare

- Insurance

- Cable TV

- Internet

- Trash Service

- Variable Expenses

- Groceries

- Transportation / Gas

- Electricity

- Dining Out

- Entertainment

- Debt Payments

- Car Note

- Student Loan

- Personal Loan

- Credit Card Minimums

- Furniture Loans

- Boat / RV Note

- Miscellaneous

- Kid Sports Fee

- Uber / Lyft

- Birthday Gifts

- Christmas Gifts

Calculating The Totals

Now that we know what the Top categories are, it's time to start filling in your sub-categories and adding totals. The instructions will assume you are using a spreadsheet, but paper and a pen can work too.

It’s important to note that if you follow our plan and stick with budgeting, you will only have to do this part once. Since you are beginning from scratch, we need to determine a starting point for your monthly expenses. Once your budget is set up, all the information you need going forward will already be neatly organized.

Financial Documents Needed

Print out the latest statements from the following accounts:

- Checking Account(s)

- Credit Cards

- Car Payment

- Student Loan

- Any Other Debt Currently Being Paid

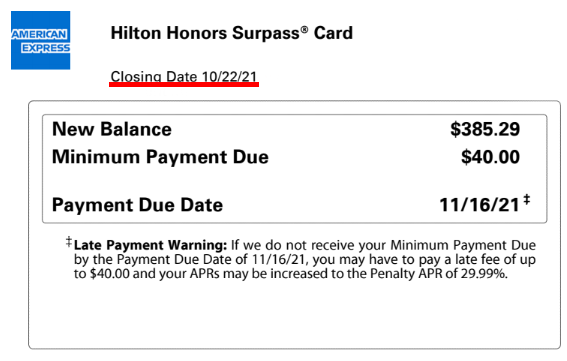

Credit card statements rarely run from the first to the last day of the month, so you may need to get the last two. Pay attention to the transaction dates, so everything is being calculated using the same time period.

Don’t worry about any investment accounts like your 401k, IRA, etc. unless you spend money directly out of them. It is highly unlikely that this is the case, so it’s best to ignore them. The only thing we are concerned with at this point is money that leaves your household as an expense.

Setting Up Your Spreadsheet

Start by putting our four top categories on your sheet:

- Fixed Expenses

- Variable Expenses

- Debt Payments

- Miscellaneous

Go through each of the four top-level categories and start adding any sub-category you can think of. Fixed will have a lot of your bills, Variable will be things like food and gas. Add your debt, and if you have any Misc. items. You won’t get them all, and that's fine. You can add them as you go.

Adding Fixed Expenses

Using your last month’s bank and credit card statements, find all the fixed expenses and put them on your spreadsheet with the cost. Make sure to review all the statements for any you may have forgotten to write down.

Once you transfer it to the spreadsheet, cross it off on your statement so you know it's recorded.

Adding Variable Expenses

You have two options when calculating your variable expenses like groceries and gas:

- Simply add them up from last month’s statements (less accurate)

- Find the average for the last three months (more accurate)

Let’s use groceries as an example.

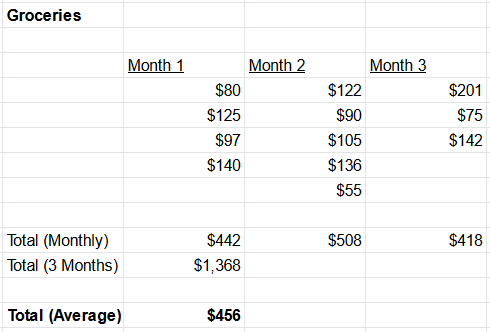

Find every instance in the last month that you spent money at a grocery store. Add up the total and put that number next to Groceries (under Variable Expenses) on your spreadsheet. If you want to be more accurate, do the same thing for the last three months, then find the average between them.

Finding the average:

Add to Expenses List:

Adding Debt Payments

Use your latest statements to find the Minimum Monthly Payment for each loan. Add these to your spreadsheet as separate items under Debt Payments (similar to Fixed Expenses).

Adding Miscellaneous

This category is the catch-all, so use the techniques listed above to calculate the totals for anything that lands in here.

Review All Your Statements

Now it’s time to go back through each one of your statements and make sure everything has been added. When this section is complete, every single transaction should be reflected in one of the categories on the spreadsheet.

Remember the note about credit card statements above. Most credit card statements have random start and end dates that don’t match with the beginning and the end of the month. Make sure to pay attention to the actual transaction dates, and ignore any transactions outside of the time period you are calculating.

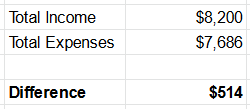

Positive, Negative or Equal?

Congratulations! You now have two incredibly important data points we will use as you become a master of your financial future.

If you haven’t done so yet, sum up your total expenses. Now subtract that number from your total income.

Income - Expenses =

Is it positive?

If so, you are on the right track, but not out of the woods yet. In this step we excluded things like saving goals, random maintenance expenses, and other things vital to a successful financial plan. We will dig into those in the next section when you build an actual budget.

Is it negative?

If so, That means you have been living above your means. It’s likely that the difference has ended up on credit cards or other forms of debt. Not to worry, we are here to help with that too.

Summary

Once you complete this step, you should:

- Know your income and living costs.

Next you will learn how to make a proper household budget (it's not as bad as you think).