A budget is telling your money where to go instead of wondering where it went.

-Dave Ramsey

The first two steps of the Proper Cents Method serve these purposes. Step 1 gave you a snapshot of where you currently are (how much you make and how much you spend).

Step 2 will focus on where you want to go.

A budget is a forward-looking tool used to decide where you want to spend your finite resources.

Imagine you arrive with a single eight-slice pizza to a birthday party with eight kids. When you set the pizza down you tell everyone that each child gets one piece of pizza. This is exactly what budgeting is. Telling the money where to go before it's all gone.

In that same scenario imagine setting the pizza down and walking away. Some of the kids are going to come over and start devouring slices, while others continue to play. After the dust settles, some of the kids had multiple pieces, some had zero, and there is no more pizza. The same thing happens when you have no plan for your money.

Table of Contents

‘Budget’ is NOT a Dirty Word

For some people the word ‘budget’ elicits bad thoughts and emotions. This is often due to people using it in a negative context. For example:

“I can’t meet for drinks, I’m on a budget.”

“My [spouse] has put me on a budget so I can’t buy that.”

“I hate budgeting because it means I can’t do anything.”

The truth is that a proper budget can set you free. Free to buy the things most important to you, free to spend time with friends without guilt, free to plan for a retirement filled with things that enrich your life.

A budget is a plan for your money.

If going out for drinks every week with friends is important to you, or buying the latest clothes is a priority, then it should be reflected in the budget. When money is properly set aside for things, you can spend it guilt free!

Impulse is the Enemy of Personal Finance

We live in a society of “I want it, and I want it now.”

Without diving too far into human evolution, the bottom line is we are absolutely terrible at keeping our wants and desires at bay in modern times. Do you really think that a $1300 phone with a slightly better camera is somehow going to materially change your life for the better, or a $60,000 SUV is going to get you to work quicker?

Newsflash - they won't.

Now multiply that across the countless items and services that you are bombarded with on a daily basis. Even if you resist 95% of the time, there are still a number of impulse buys that can derail your finances over a month, year and even a lifetime.

Impulses and poor planning are two of the biggest reasons why many people do not get ahead financially.

Budgets are the Antidote to Impulses

A budget is a predetermined plan for your money.

When you start looking at our consumer-based world through the lens of your budget, you begin to change. You stop looking at everything you want and start thinking about what is important. As you come to understand your finances more and more, you start prioritizing things in a much more responsible way.

Rather than running out to buy the latest iPhone, you will develop a plan to upgrade. Perhaps setting aside $100 a month to pay cash, rather than putting it on a credit card. After realizing how long it actually takes to save $1300, you might even start looking at last year’s model because you could save $500 and put that toward something else that matters.

Just like how the impulse purchases really added up, so does the money you save.

Jars, Envelopes and Buckets

One of the most rudimentary (but still effective) ways to make a budget is simply dividing your money into separate jars and/or envelopes with labels on them. You may have them labeled as:

- Bills

- Gas

- Food

- Fun

- Etc

50 years ago, this method made a lot of sense. You got paid, cashed your check, and divided your money out into the necessary categories. A major advantage to this process is you could actually visualize how much money you had at any given moment.

Unfortunately for most of us these days, operating strictly in cash is not really an option. It may work for certain expenses, but not so much for others.

Even though this method may be a little outdated, the concept remains the same. The difference is we use paper, spreadsheets or software to make our jars and envelopes. To avoid confusion with the old method, we will call them BUCKETS going forward.

So rather than having a bunch of mason jars sitting on the kitchen counter, your money can sit in a single bank account with software on your phone and computer that tracks each expense and removes the correct amount from each bucket.

For example - After shopping at the grocery store you can immediately input a transaction on your phone that deducts the exact amount from your Food bucket. Next time you (or your significant other) goes to the store, you will know exactly how much is left to spend on groceries.

Getting Started

If you have already finished Step 1, you’ve completed the lion’s share of the work. You should have a list of buckets, along with roughly the amount you spend from each on a monthly basis.

The next thing to decide is how you want to keep track of your buckets and expenses. There are three primary ways:

- Pen and Paper

- Spreadsheet

- Budgeting App

This choice will boil down to personal preference, but we highly recommend finding a budgeting app you like. Most apps will integrate with your bank and credit cards, making transaction tracking a breeze. Attempting to reconcile everything on a piece of paper or in a spreadsheet is not for the faint of heart.

If you don’t want to research the exhaustive options of budgeting software out there and just want a recommendation, go with You Need a Budget (YNAB). This will be the software we use for examples.

Connecting Your Accounts

Assuming you choose the budgeting app route, connecting your bank, credit cards and debt accounts directly to the software will make the process a lot simpler. If you prefer not to, most apps allow you to manually input transactions or download them directly from your bank and import them.

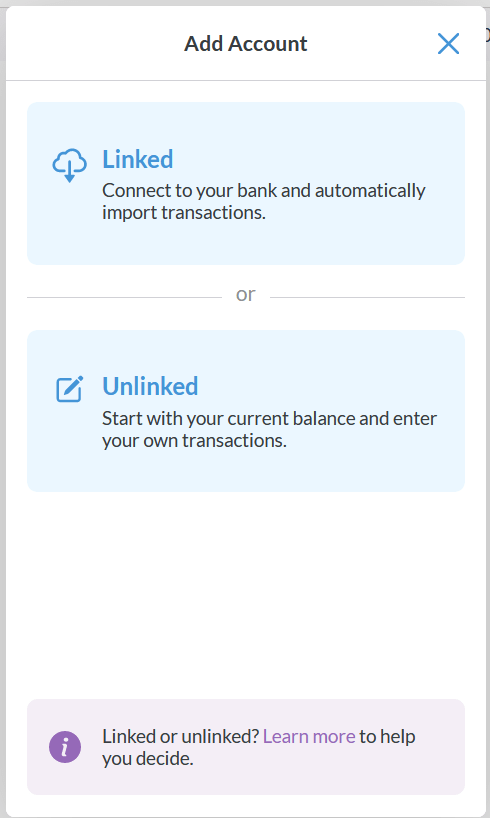

Since we are using YNAB for this guide, this is how it looks adding an account:

In YNAB (and many other apps) linking your account directly with the software will allow it to automatically pull transactions that have completed. This process makes it easier to manage, but you do need to give access to your account.

If you prefer not to let the app access your records, choose UNLINKED and manually enter them or download and import your transactions on a regular basis.

Setting Up Your Spending Buckets

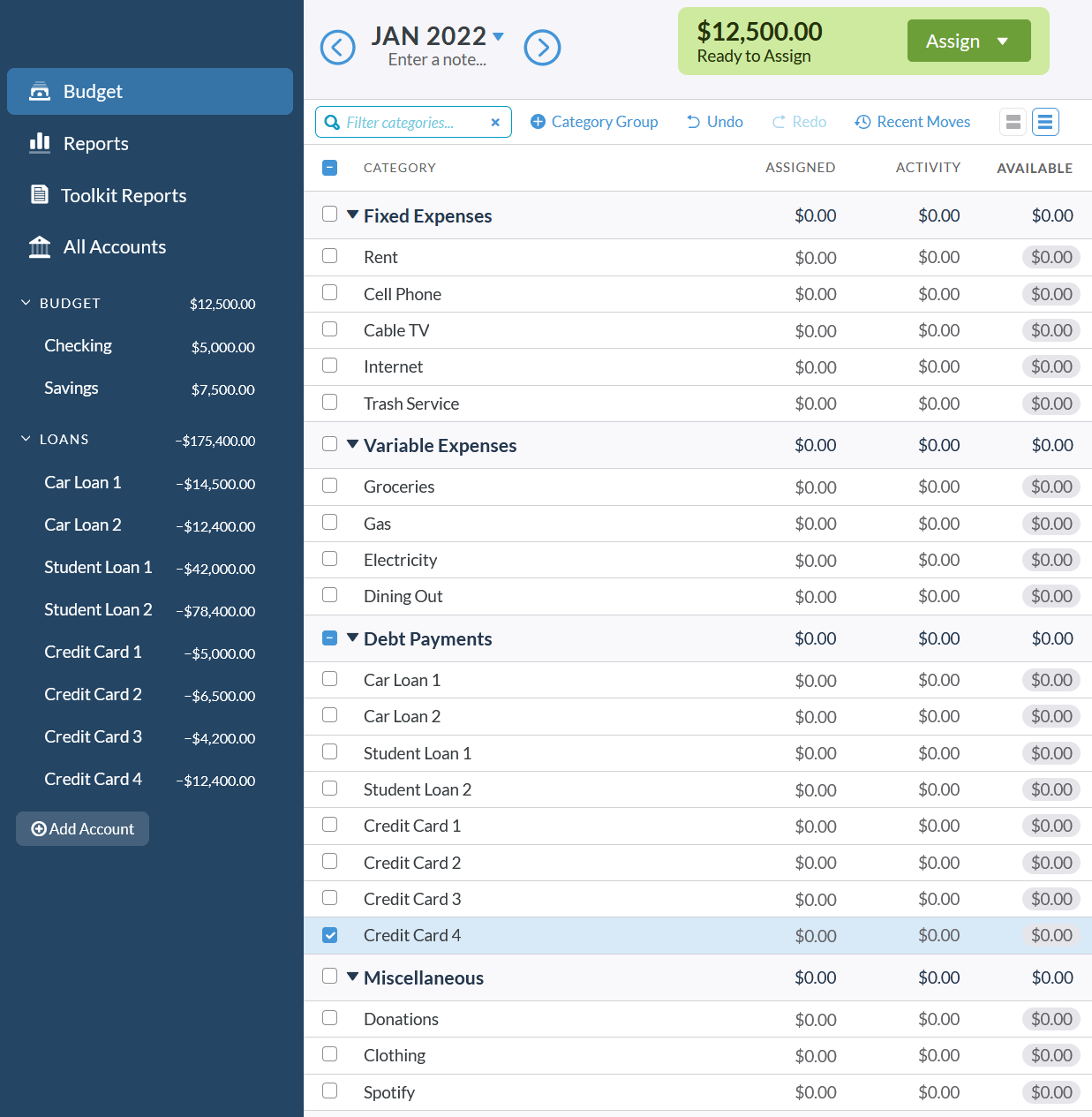

Start by transferring your spending buckets you developed on Step 1 into your budgeting software. This is pretty straightforward, but will vary depending on which app or process you choose.

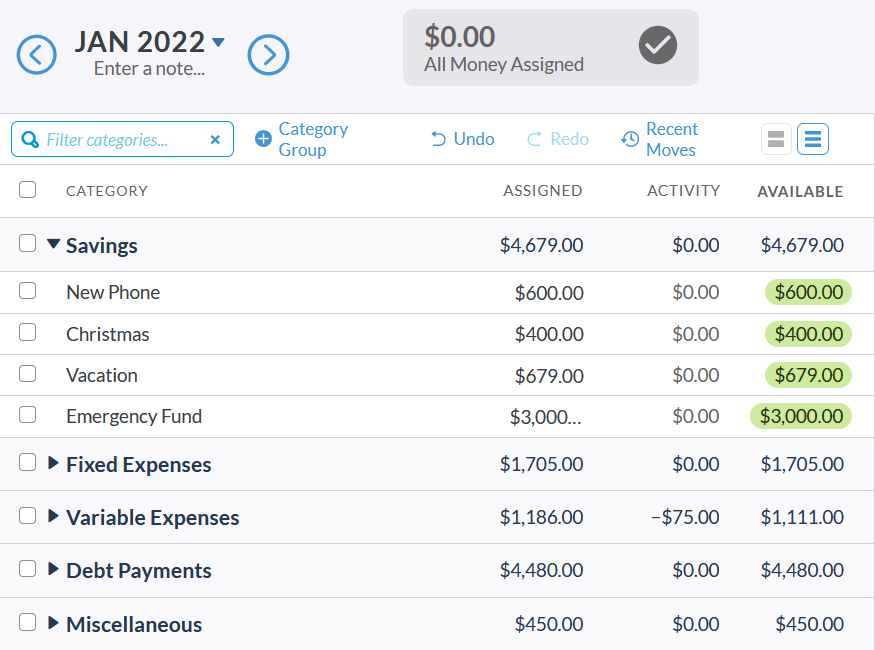

This is what it would look like in YNAB using the categories from our Step 1 example:

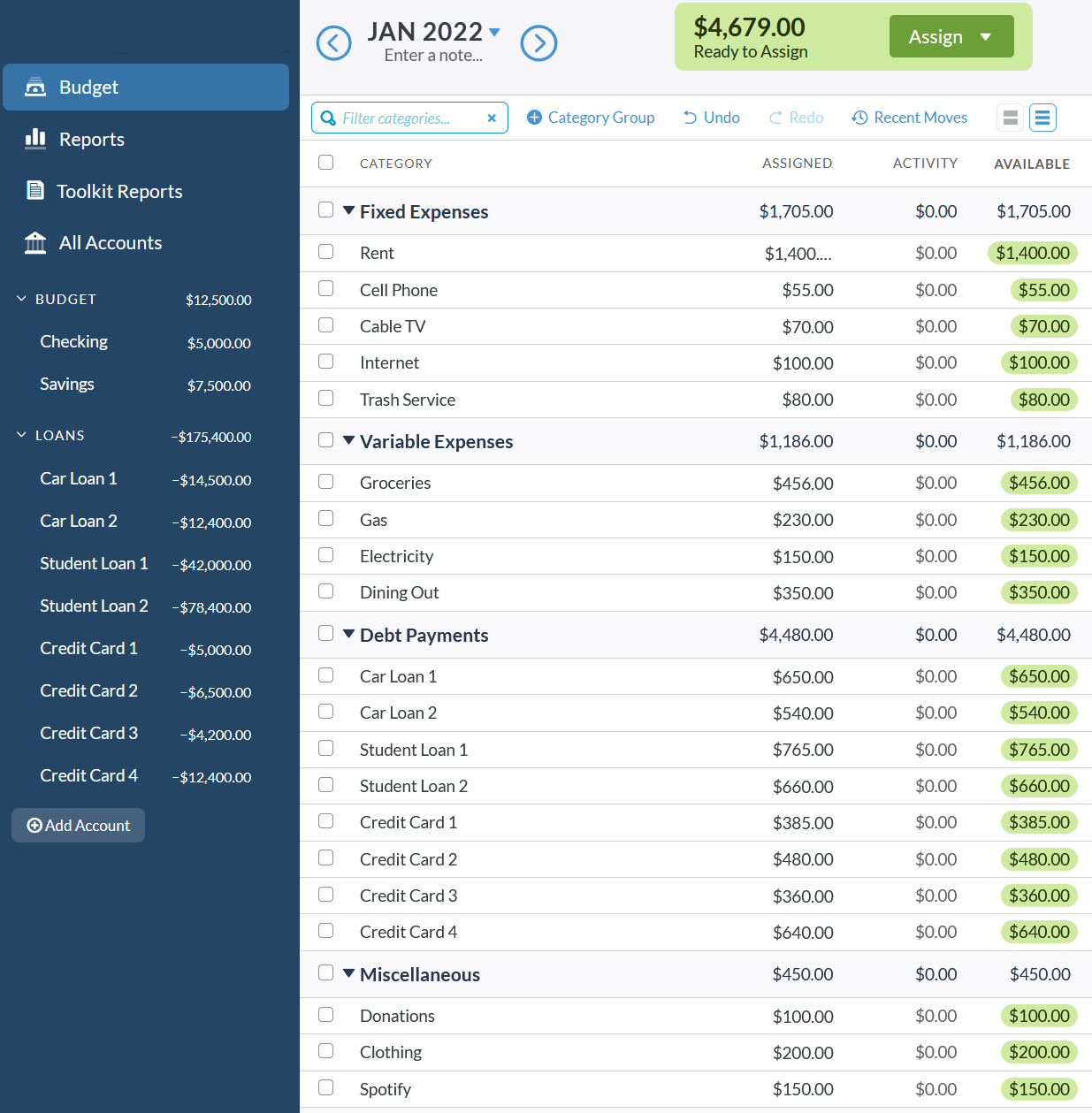

Next you will decide how much money to put into each bucket. This is where the real power of the budget begins. Here is where you start to tell your money where to go and what to do.

Many of your buckets, like bills and minimum debt payments, will not have much wiggle room. For the others, this is the point when you determine how important they are. If you look at your numbers from Step 1 and see you are spending $1,000 a month on restaurants, now is the time to decide if that is a priority for your money. If not, move some of it to a different category, or better yet, save it (we will cover savings buckets below).

Here is the YNAB layout from our example in Step 1:

Transaction Tracking

Once you have assigned your dollars into specific buckets, it is time to start tracking your incoming transactions. Depending on the software you choose, you may be able to go back and start from the beginning of the month. If you choose YNAB, you will start tracking your transactions going forward only.

Let's see it in action.

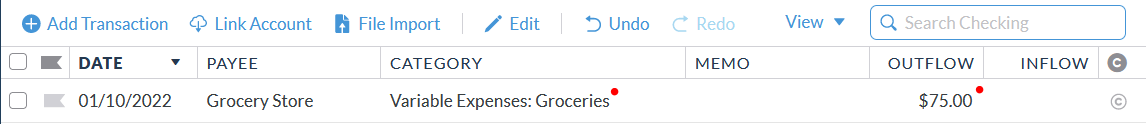

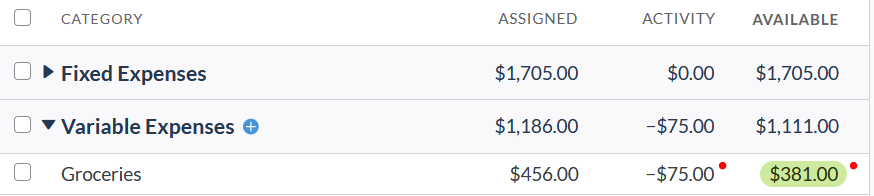

Suppose you go to the store and spend $75 on groceries. This is what you are going to see happen after filling in the transaction:

By choosing the Groceries category for that transaction, the app automatically deducts the $75 from the available bucket balance, leaving you with $381. As long as every transaction you make gets added to one of the available buckets, you will always have a clear picture of how much money you can spend on a particular item or service.

The beauty of this is you can spend money in a category guilt-free, so long as there are funds in the bucket.

It’s really that simple.

Savings Buckets

Up until this point we have focused on the expenses going out of your household. The other side of the coin, and arguably the most important, is savings.

Some people prefer to lump their savings into one big bucket, and then draw off of it when needed. This is an OK strategy, but should be reserved for people with a lot of experience with budgeting.

For the rest of us, having specific buckets for separate goals helps to keep things on track. Here are examples of common savings goals:

- Emergency Fund

- House Down Payment

- Vacation

- Christmas

- New Phone

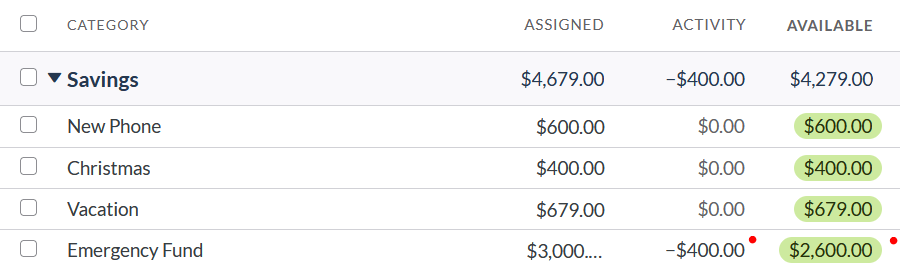

Let’s take a look at a few of these in action, as part of our YNAB example:

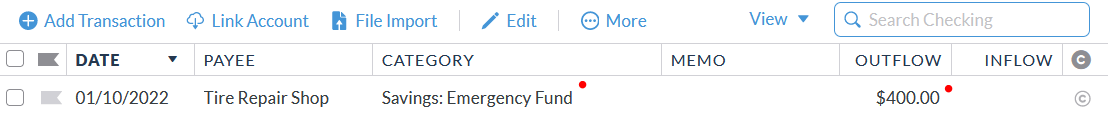

Now let’s pretend you blew a tire and needed to replace the front two on your vehicle for $400. Since this was an unexpected emergency, we will debit the Emergency Fund bucket by selecting that in the category section:

As you can see, the app deducted the $400 expense from your emergency fund, leaving you with $2,600.

This same principle works with other savings buckets. You will notice we put Christmas on the list of common savings goals. Christmas is not an emergency, and should be planned for all year. By creating a savings bucket and adding to it all year long, holiday shopping doesn’t need to be filled with stress over the looming credit card bill.

Imagine putting $200 a month into the Christmas savings bucket every month. Come December, you will have $2400 already set aside for gift shopping!

Budgets Should Be Flexible

Budgets are not static, and will typically need to be adjusted as the month goes on. It’s hard to predict everything that will come up, especially in the beginning of your budgeting journey.

That is perfectly OK and normal.

Try not to get discouraged if something comes along that blows up one of your buckets. It happens to everyone from time to time. It’s perfectly fine to move money around from category to category.

There will also be months where you overspend what you have. That’s OK too, just try not to make it a habit. That is what got you into this mess in the first place.

Every month you will learn more and more about your spending habits, the process of budgeting, and a number of other ancillary things that will bring you closer to financial independence. Even months that go completely sideways will be a learning experience that you can build on in the future.

Summary

At this point, you should:

- Know your income and living costs.

- Have a budget and tracking expenses.

In the following Step you will learn what to do with all those pesky high-interest credit card balances.