UPDATED: April 20, 2022

Target retirement date funds are becoming increasingly popular. Perhaps you see these funds within the various options inside of your 401k. Or, your financial advisor may be encouraging you to get allocated to target date funds based on your retirement plans. But you may be wondering; what is a target retirement fund exactly? How do they work? What are the advantages and disadvantages of them?

Table of Contents

What is a Target Retirement Date Fund?

A typical long-term investor will usually have a mix of stocks and bonds in their portfolio. The general idea is to gradually shift more of the portfolio assets from stocks to bonds as one gets nearer to retirement, since bonds are historically less volatile. As someone gets to retirement, they move from asset appreciation to asset preservation, so the wild swings of stocks can be off-putting and risky.

The balance between stocks and bonds is called asset allocation. Some investors choose to balance their allocation using different index funds, and manually adjusting them as time goes on. For those that may be less interested in tracking and tinkering, a target retirement date fund can do the heavy lifting for you.

Target funds are mutual funds or ETFs that own underlying index funds made up of stocks and bonds. Each target fund has an associated date (such as 2045), which investors can match to the time they think they are going to retire. As the date gets closer, these funds automatically sell more stocks and buy more bonds to de-risk the fund as owners get closer to retirement. They are the perfect "set it and forget it" product.

How Does a Retirement Fund Work?

An investor first needs to set a target retirement year. The younger you are, the harder it is to predict what year you’ll retire in - but most folks aim to retire between 67 and 70 years old to maximize their social security benefits.

Don’t worry about getting this 100% right if you’re 30 years old. You can always adjust your target year by moving to another fund as the years pass by. Getting within a reasonable ballpark will be more than sufficient early on.

Once this target date is established, an investor will invest in a TDF that is aligned with their retirement year. For instance, one may be wishing to retire at age 70, which will occur in the year 2061. An investor would choose the 2060 target retirement date fund to sync up their work & retirement timelines.

The foundation of the TDF will be built off of growth and income producing investment options. Depending on how close to retirement you are (year 2061 for this example) the fund will automatically adjust how it anchors its investment approach.

As an example - if you are 41 years away from retirement, the fund will be heavily focused on investment options that produce greater growth. These investment options inherently come at greater risk but the investor would have 41 years of working to earn back any loss they take on their investment. Capital appreciation is the name of the game this far away from retirement.

As you approach your target retirement year, the risk/growth proportion shrinks. The fund will re-balance itself and focus on investments which have lower risk and produce a fixed income. As you approach retirement your main focus should be capital preservation and income production, which will align with the funds investment approach.

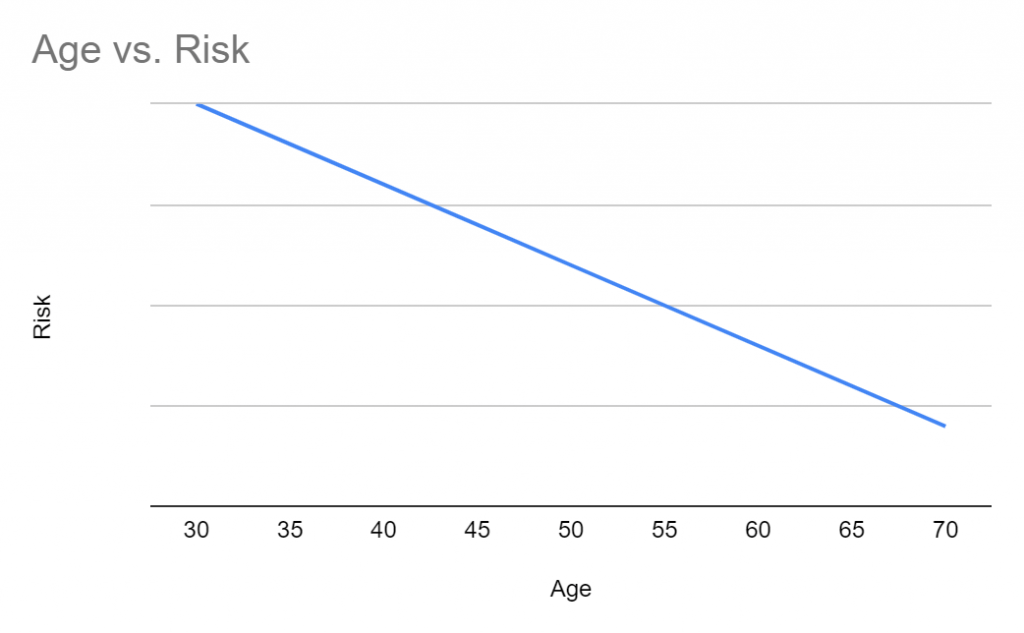

Here’s a simple chart that further explains the above point. As displayed, the Y axis represents risk and the X axis represents one’s age. As you approach the target retirement age, 70, the risk reduces.

A target retirement date fund will invest in a variety of sectors and investment vehicles to keep a well balanced and diversified investment portfolio. A fund will be an aggregate of; growth stocks, blue chip stocks, dividend paying stocks, REITs, mutual funds, bonds, and even various international markets. All in all, this wide approach reduces your overall risk, as you aren’t overly invested in any one area.

The Advantages

- Instead of an investor or financial advisor doing the manual work of selecting various investment vehicles and re-balancing the asset allocation of each vehicle yearly, a target retirement date fund does all of that work for you. For the investor, this fund runs on autopilot.

- These funds force you to set a goal and stick to the plan. Many people fail to ever set a retirement goal, and those who do often struggle with sticking to the plan. Simply putting your money in a target retirement date fund helps you accomplish both.

- Diversification. As mentioned above, these funds will invest in a variety of investment vehicles and options. Ultimately, this helps protect your money as your money will never be over invested in any one sector or investment type.

The Disadvantages

- Despite the benefits an autopilot investment plan provides, the annual returns may not be all that exciting. By nature, these plans are less risky than individually selecting stocks considering the diversification each plan will provide.

- Life changes. You may be forced to retire 10 years early. This early retirement may come on abruptly, and if it did occur, your investments may not be properly allocated for an early retirement.

- A target retirement date fund typically has its own expense ratio. Considering the retirement date fund is really just an aggregate of various other investments, including mutual funds, you may be paying extra fees.

- Taxes can be a problem. Since target funds have fairly large bond allocations (that get bigger as time goes by), they can produce a lot of income on an annual basis. This income it produces is usually taxed at ordinary income rates, just like a paycheck. Its usually advisable to hold these types of funds in tax-advantaged accounts like a 401k and/or an IRA.

Summary

A target retirement date fund is an investment vehicle which focuses on your retirement age. The fund will automatically re-balance what it invests in throughout the years. As you approach your retirement target, the fund will focus on reducing risk and providing a revenue stream for its investors.

It is never too early to start planning for retirement. A target retirement date fund is a great tool to use and provides a safe, hands off investment approach. The sooner you get started, the greater upside potential you have. Review the details and options of your 401k, or contact a financial advisor, to get started.

Leave a Reply